Mohammad Sazzad Hossain

The history of the actuary profession does indeed date back to the seventeenth century, with the emergence of the first actuarial roles and practices. Actuaries are professionals who assess and manage financial risks, particularly in the fields of insurance and pensions. Their work involves analyzing data, calculating probabilities, and making predictions to help individuals and organizations make informed decisions regarding risk management.

In the early days of the actuarial profession, the primary focus was on calculating mortality rates and estimating life expectancies for the purpose of pricing life insurance policies. Actuaries would analyze data on deaths and use statistical methods to determine appropriate premium rates for different age groups and risk categories.

Insurance, a risk transferring mechanism involves risks in between the insurer and the insured. Risk is the uncertainty/probability that something unwanted to occur in future. Whereas, an actuary gauge the risks involving an certain insurance policy and forecast the future uncertainty of claim reserve fund, which should be maintained by the insurance company to settle future claims to be pending with. Therefore, it is quite evident that an actuary has been, undoubtedly, a personality of necessity, a revolutionary game changer in insurance arena, determining the mortality table of population for life insurance and pricing of policies and determining reserve fund for future probable claims by policy holders, the insureds, and transformation of organizational structure, called exponential actuary, for general insurance industries.

Since from the inception to the winding up of insurance company, actuary plays the leading role of constructing a protection barrier of insurance company, the very industry, prone to uncertainties. Pattern and intensity of risks, differ in regard of societies,countries,certain geographical locations and demographic structures of population. Instantly,a disaster prone country is more risk prone than less disastrous country, obviously, risks correlated variables to be traced out and be assessed, an emergency ,this very circumstance, an actuary comes in, play the role of a trouble shooter tracing out related variables ,those intensities and frequencies as well.

Disaster prone countries like Bangladesh ,India,Japan,Indonesia,Philippine and others having mostly insurance feasible environments and components,inurable interests as well along with greater exposers to risks of insurance companies in regard of survival issues,getting back to the same financial position as was the case for victims earlier i.e the insureds and application of law of large number,benefitting the insurers to stand still.

Expanding economy resulting in rapid boom in the production line ,sourced from fastly growing industrialization and international trade ,finance,keeping pace with ,exposer to risks of insurance industries and stakeholders, targetpopulation clusters is widening,while narrowing path of thinking and headway to complicated point of messy situations ,the actuary comes forward to making insurance entities to see into the future thru’ third eye ,an actuary, in a very prudent ,confidential and internationally recognized way- statistically proven as well.The larger the policy holders,the larger the profit margin,side by side,liabilities -pending claims as well as underwriting expenses increase accordingly.Every insurance entity brainstorms herself to have clear view of probable pending claims would be ,after imminent future and later,what should be the reserve fund then,this is done by ‘Reserve Valuation Actuary’.Whereas ,a ’Pricing Actuary’ determines the price and the rate of premium for a particular policy.In case of life insurance, an actuary establishes the Mortality Table of a certain cohort(certain pop^n of same age) for target population regarding their survival or death up to which time limit they would survive. By doing this,insurance companies can categorize risks prone target population and estimate future liabilities, they would be burdened with. The dimensions of economic, trade and financial activities shifting the mode of operationeveryday,digitalization and automation ,impacting almost everything.Coping up with,actuaries are also shifting gears from manual data analysis,Ms Excel to machine learning,python coding,R,ultimately linking to datascience,Artificial Intelligence(AI) and more advanced statistical tools dealing with uncertainty for certainty and the maximum likelihood estimation of expected reserve fund,quantifying risks for insurance beneficiaries for optimum strategy, there by embarking on statistically significant journey from the past to the uncertain future.

The opportunities of actuarial know-how are quite slim herein developing countries due to insufficiency of consciences of insurance and image crisis,a lack of social dignity of insurance personalities.Insurance ,a growing industry,the problems and the opportunities need to be addressed .At the state level,several time befitting initiatives were launched to brighten the image of this sector. All the initiatives will find its way certainly thru’ establishing risk analysis division in insurance companies led by a statistician and econometrician having actuarial and risks quantifying knowledge.

In regard of Bangladesh ,insurance market share amounting approx. Tk,14,392.00(BDT) core whereas non- life insurance market share amounting Tk.4,137(BDT) core and growth rate 10.5% on the other hand life insurance premium amounting Tk.10,255(BDT) crore (Source IDRA), having growth 7.63% in the year 2021. The insurance penetration is less than 0.5% herein Bangladesh.

Insurance market expanding as a whole,salary structure of actuary in Bangladesh is not quite satisfactory,the average monthly salary ranges from Tk.17,200(BDT) to Tk.59,500(BDT) having average salary increment at 5% versus the average annual increment of 9% in regard of energy,IT and healthcare sector,whereas average annual salary of an actuary in India is Tk.2,67,392(BDT) and in Pakistan , the average annual salary is Tk.19,373(BDT).Actuary profession in neighbouring Nepal,Bhutan,economically, deadlocked, barren Srilanka yet to boom and to be focused as well. (Source -Salary Expert).

New and newer insurance products i.e. policies, would be designed and placed on the market place, creating the expected depth,volatile market would turn out to be a stable one , the point of equilibrium in financial economy, making it’s journey a smoothy with a serene wind up ,if in state of emergency, therein.

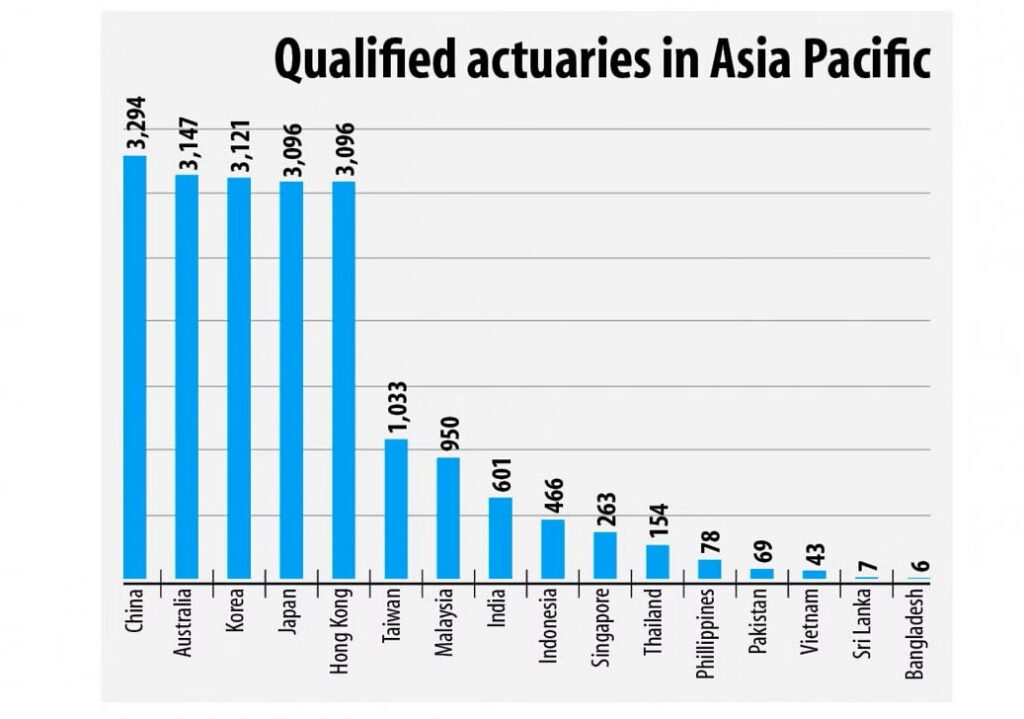

According to the latest data,there are only 06(six) actuaries in Bangladesh.The underlying histogram showing the very poor state of this professions in Bangladesh.

A Developing Trend of Actuary Professions,BD lies beneath-(source -online):

Reasons behind not increasing the number of actuary professionals –

1.non-educational opportunities-lack of educational institutes in the country regarding this.

2.reluctance of insurance companies to set up actuary department,though direction given to implement actuary department several times.

3. Lack of qualified teaching and interested meritorious candidates.

Only Metlife shows the way, employed 3(three) actuaries following article67(1) of Insurance Act2010.

The ministry of finance,through FID, aiming Sadharan Bima Corporation along with insurance companies circulated many a times to attract candidates to get enrolled abroad to create efficient actuary professionals.

The writer is an insurance professional. He can be reached at hossainmohammad3232@gmail.com